What would you do if your paycheque was in millions? Perhaps you’d buy a mansion, a Ferrari or pay off all your student debt. But with a lump sum of money comes other big issues, which is why a lot of people decide to hide their money in secure offshore companies. The Panama Papers scandal reached headlines back in 2016 when 11.5 million documents of the world’s fourth biggest offshore law firm were leaked. According to the Guardian, these included accounts pertaining to the hidden wealth of the world’s most prominent leaders, celebrities and politicians such as Vladimir Putin, Nawaz Sharif and several others. While using the services of offshore companies aren’t illegal, the files raise fundamental questions about the ethics of such tax havens – and the revelations are likely to provoke urgent calls for reforms of a system that is arcane and open to abuse.

In our lecture this week, we talked about the ‘six degrees of separation’ and how for any pair of people, there is a friendship path between them. This would mean that it is easy to find patterns that show connections among different people. However, a 2020 research study conducted by an assistant professor, Mayank Kejriwal, concluded that the Panama Papers network of offshore entities and transactions were all disconnected and did not contain any triangular structures. It is precisely this disconnectedness that makes the system of secret global financial dealings so robust. Because there was no way to trace relationships between entities, the network could not be easily compromised. This study was performed with a focus on structure as a means of expressing and quantifying the complexity of the underlying system.

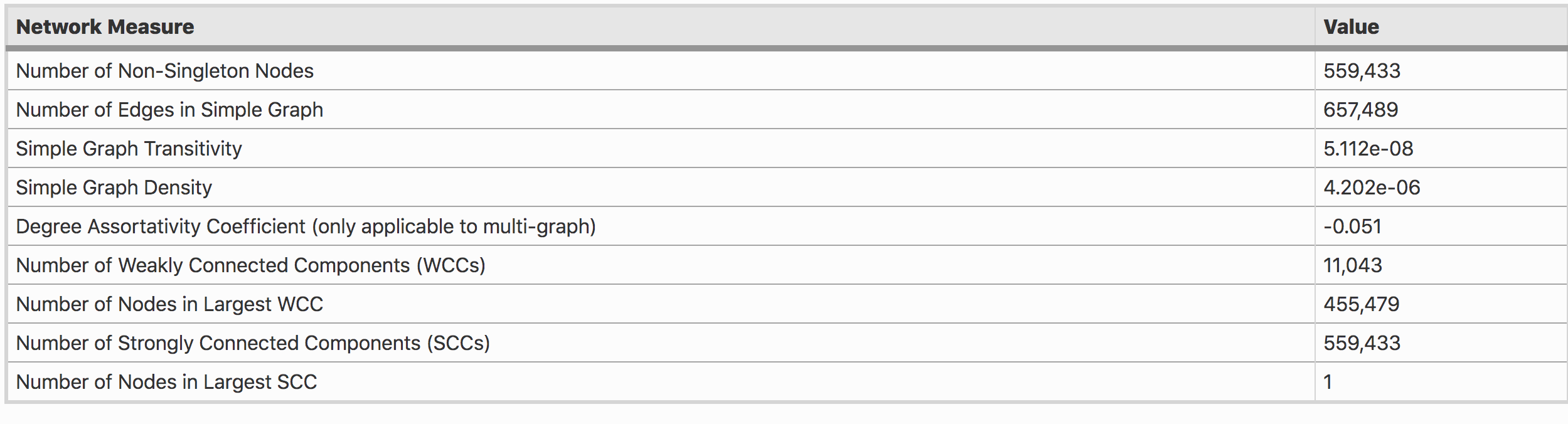

In his research, Kejriwal calculated the density, weakly connected components (WCC) and strongly connected components (SCC) of the network. Table 1 shows that there are no non-trivial SCCs in the graph G (every node falls in its own SCC when partitioning the graph into SCCs). He also calculated the transitivity of G which is the fraction of all possible triangles present in the graph. Transitivity for multi-graphs is not well-defined; hence, it is only shown for the simple network equivalent of the Panama network. Overall, the network is extremely sparse and unlike social networks, the transitivity is also very low.

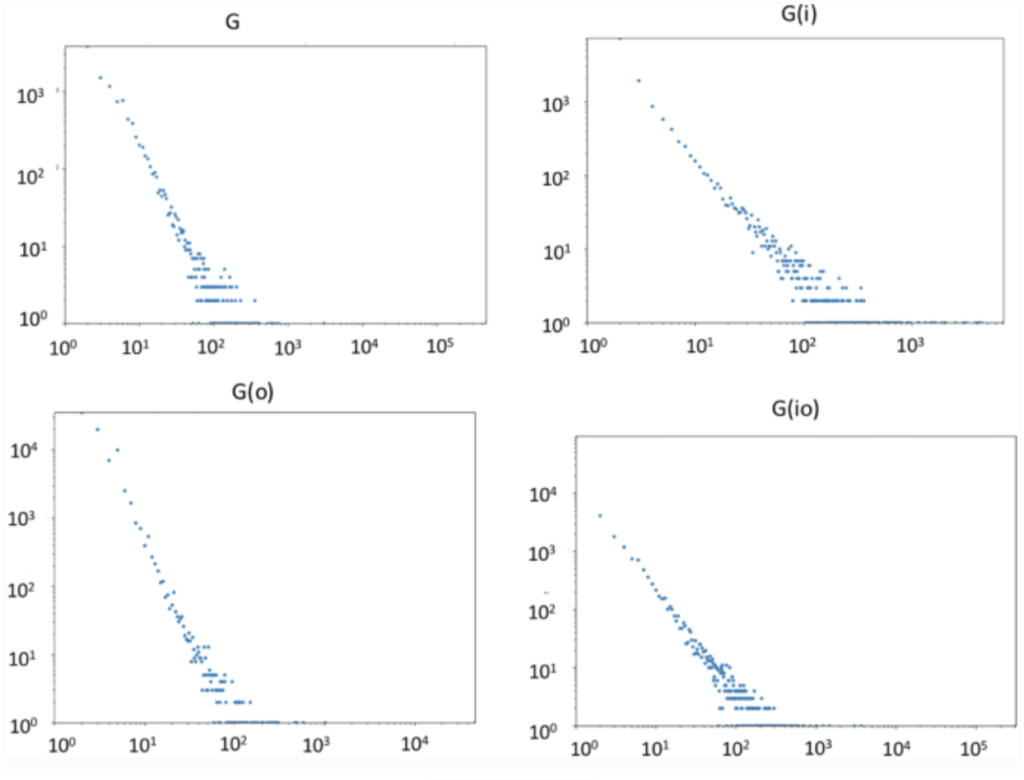

The above figure shows a lack of connectivity, and a systematic distribution of component size, which is an indication that the networks are dissimilar from social networks which tend to be connected (or almost connected). In other words, the Panama Papers do not seem to exhibit any ‘small-world’ phenomenon.

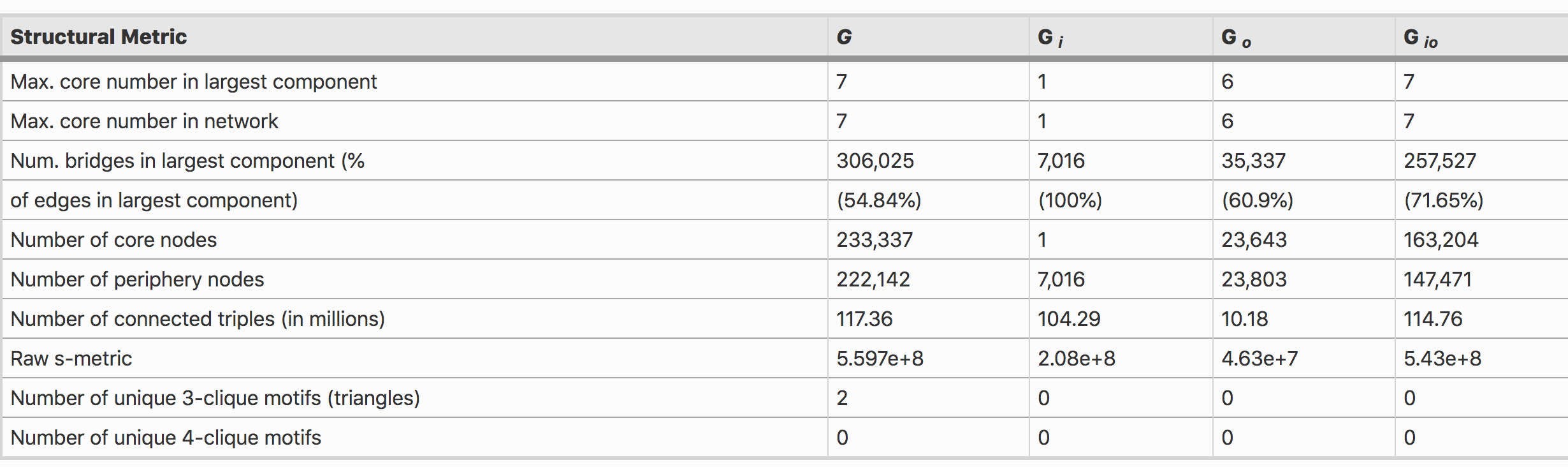

Table 2 shows that the number of bridge edges in the network are very high (and sometimes extreme in the case of Gi which is 100%). This suggests that every edge in the largest component in Gi is a bridge.

In particular, the lack of small-world phenomena in all selectively constructed and higher-order networks seems to be suggesting that a different theory is at play in this dataset, and that disconnectedness is a fundamental, emergent feature. Assuming the connected components proportionally capture some level of corrupt activity, corruption itself would seem to be a rather robust phenomenon, since targeting a few nodes would not bring the whole structure ‘down’. Even more disturbingly, data suggests that the larger components would also have limited utility in cracking down on overall illicit activity. Finally, we should consider the dynamic nature of entities: offshore companies can quietly and quickly change ownership and beneficiaries in many jurisdictions, intermediaries can be replaced or shut down, and new shell companies can emerge, all in short order. Robustness is, therefore, an inherent feature of this system in more ways than one.

Since small world phenomena did not occur in a single network, and the distribution of connected components seems to follow a clear and consistent trend throughout, it suggests a stark difference between patterns exhibited in small-world networks.

According to Kejriwal, even if you randomly connect things, in a haphazard fashion and then you count the triangles in that network, this Panama network is even sparser than that. He also added, “Compared to a random network, in this type of network, links between financial entities are scrambled until they are essentially meaningless (so that anyone can be transacting with anyone else).”

These reasons are why it is challenging to crack down and trace the network of these systems.

Sources:

https://www.sciencedaily.com/releases/2020/09/200929152152.htm

https://appliednetsci.springeropen.com/articles/10.1007/s41109-020-00313-y

https://www.theguardian.com/news/2016/apr/03/what-you-need-to-know-about-the-panama-papers