With Black Friday around the corner, North America will have a very different experience of this retail holiday than the last decade.

Since the inception of malls, shopping in person has been wildly popular amongst consumers, they are able to view their products and try it before purchasing, which are major benefits for making the payment decision. However, competition arose when online giants such as Amazon, eBay and various dedicated websites started to gain traction. This has created the current online shopping culture, buying from the comfort of our home and delivered to our doorsteps.

The circumstances surrounding this year is worse for retail and malls. The ongoing pandemic is likely to last through most of the major holidays for shopping; Black Friday, Cyber Monday and Boxing Day. Many of the retail chains have already been closing down some of their less prominent locations and with social distancing and various lockdown throughout the current event, shopping in person has never been more unpopular. On the other hand, the boom of online shopping is going on strong as it became one of the best ways to cure our retail needs in this global situation. Not all hope is lost, with every turn of events comes an opportunity. At the moment, many of the stores are closing their physical location, this in turn opens up more avenues for bigger chains to leverage.

One of the interesting factors about Game Theory, is that it even appears in choosing the location for retail shops. The reason why similar businesses open next to each other is due to this configuration being the Pure Nash Equilibrium where both parties cannot deviate from the current location to gain anymore benefit.

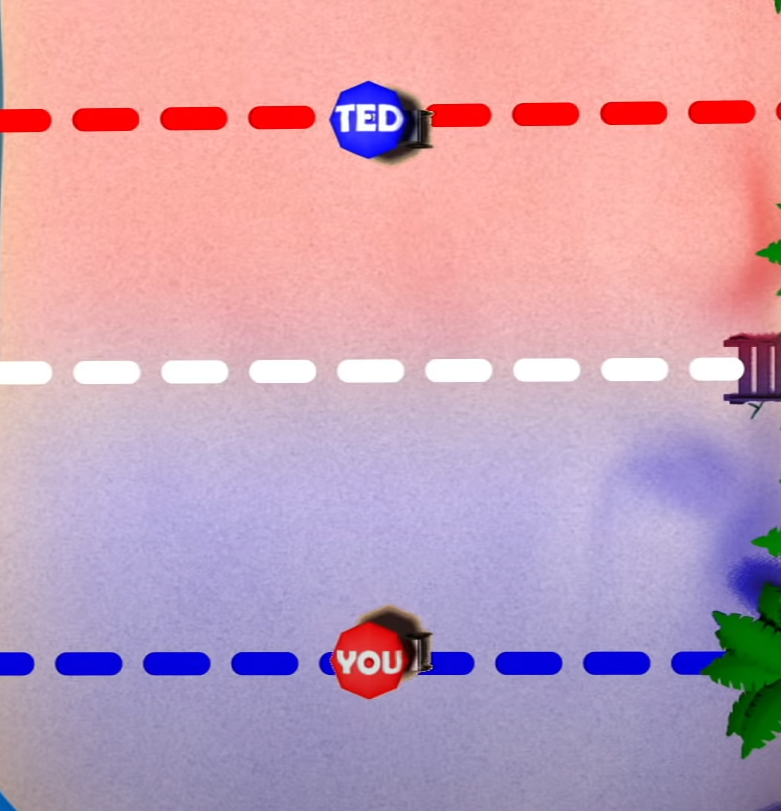

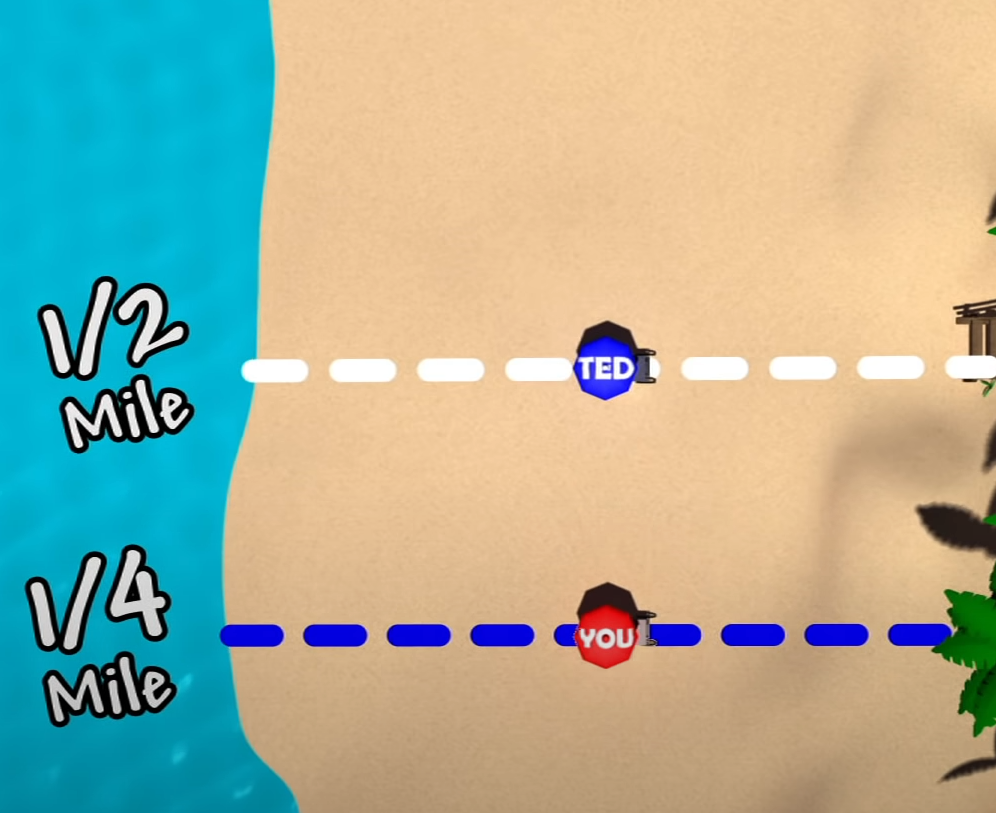

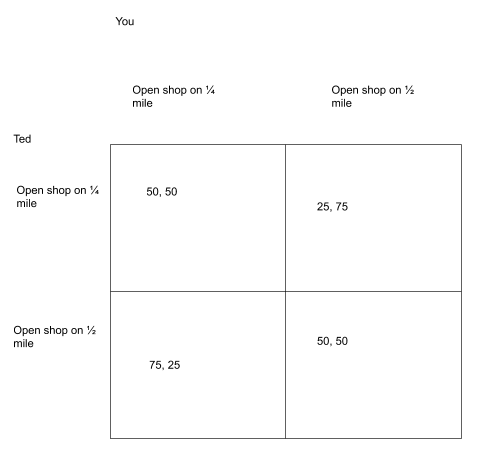

Let us consider the following situations (from TED-ED)1. Two competitors are selling ice cream on the beach. In the first scenario where a line down the middle separates them, and they each occupy their own halves. In this case, both parts would get half of the sales, but there is a better play for one of the stores. Consider figure 2, where Ted moves to the middle, now he gets his original sale and splits the sale between ½ mile and ¼ with you. Both parties would continue to move to the advantageous position until they both settle down in the center where they cannot deviate from that position to gain any benefits.

How this does apply to the current pandemic? With the closing of many stores, the bigger players of retail sector can purchase more storefronts to obtain a bigger payout than their competitors in physical locations. Consider the previous scenario, however, this time Ted has 2 stores instead. In that case, you will always obtain a lower payout than Ted where he can surround your store on either ends and taking over half your sales. Normally, this would not be achievable due to the cost of purchasing storefronts and competitors owning a location nearby. But this pandemic has opened up many retail spaces for taking.

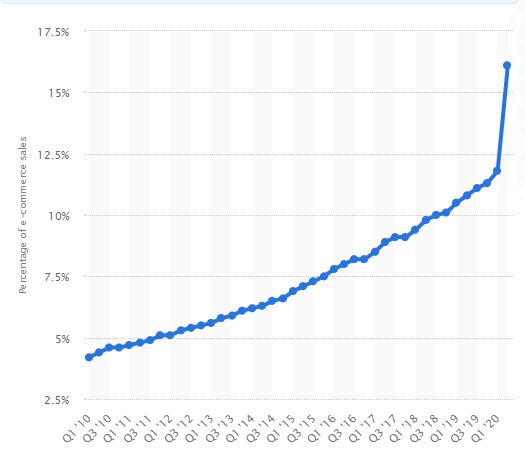

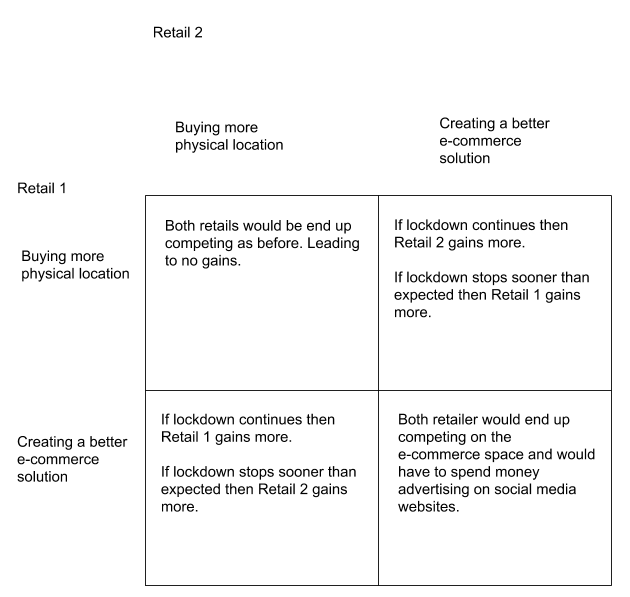

Next, let us consider the e-commerce side of shopping. With the current pandemic, a lot of the purchases are being made online in e-commerce giants like Amazon. With this in mind, would it be more beneficial for current market to purchase more storefronts to attack competitors on the physical locations side, or is the money better spent on establishing their own online store and delivery routes instead? The answer to this question lies within the payoff of each situation and it’s hard to calculate without knowing the specific numbers. Even with the current pandemic, we can see that the percentage of sales rising from e-commerce is still only a fraction of the sales a store can gain from having a physical location. However, we are comparing the gains of purchasing more storefronts vs diversifying and investing the funds into producing an online shopping solution. If we were to construct a payoff matrix, the matrix itself would not have any Pure Nash equilibrium and instead would be mixed strategy. As the best strategy would depend on the expected payout and the company would then split their funds accordingly.

In conclusion, this Black Friday might be the first mark towards a very different shopping experience in the next decade. If the sales figure points to online shopping producing a better net sale, then it is possible more retail giants would not hesitate to close down their less popular locations and invest into a better e-commerce. However, if the sales figure points towards the traditional method being superior, then we might see the bigger players of retail popping up more stores over the next few years. Although, a major factor to consider, and the creator of this situation, is how long will lockdown and the global pandemic last. This factor will also be a major player in deciding the retail landscape for the next decade.

Source

- https://www.youtube.com/watch?v=jILgxeNBK_8

- https://potloc.com/blog/en/why-successful-retailers-are-opening-in-front-of-their-main-competitors/

- https://www.forbes.com/sites/gregpetro/2019/03/29/consumers-are-spending-more-per-visit-in-store-than-online-what-does-this-man-for-retailers/?sh=793917437543

- https://sleeknote.com/blog/online-shopping-statistics

- https://www.forbes.com/sites/sap/2020/11/19/how-the-holiday-shopping-experience-will-be-different-in-2020and-what-it-means-for-frontline-staff/?sh=7000814b6e8e

- https://www.forbes.com/sites/pamdanziger/2020/05/06/sooner-rather-than-later-is-best-when-it-comes-to-coronavirus-induced-retail-bankruptcy-filings-but-for-j-crew-it-may-be-too-late/?sh=1d5d5d1b505e

- https://www.styledemocracy.com/canadian-bankruptcies-store-closures-in-2020/

- https://www.statista.com/statistics/187439/share-of-e-commerce-sales-in-total-us-retail-sales-in-2010/#:~:text=Share%20of%20e%2Dcommerce%20sales,U.S.%20retail%20sales%202010%2D2020&text=In%20the%20second%20quarter%20of,quarter%20in%20the%20previous%20year.