I’ve lately become quite fascinated by the financial world. This is generally a broad topic and includes subtopics such as equity markets, supply and demand curves, business acquisitions, etc.

What I have been observing recently is that a lot of mainstream financial analysis revolves around stock markets, mainly due to the rise in retail investing. In fact some great blog posts from this very class in past years do a great job of applying network analysis to equity markets.

However, I’ve personally seen a lack of blog posts and publications about a more socioeconomic and encompassing topic: venture capitalism. In a nutshell, venture capitalism is the concept of funding start-ups and early stage companies by individuals or firms with investment capital. I find this topic incredibly interesting because it involves substantial sums of money (often millions or even billions of dollars) transacted by a relatively small number of individuals or firms. During my exploration, I came across what I found to be an extremely relevant paper by researchers in the Department of Sociology at Tsinghua University in Beijing.

This paper explores how a small-world network can be formed to accurately model the relationships between Chinese venture capitalist (VC) firms. As we know from class, small-world models aim to maintain high clustering with short paths at the same time. This helps model real social networks more accurately. While the paper is quite expansive, I’d like to focus on how the model was developed, its key properties, and how it was validated.

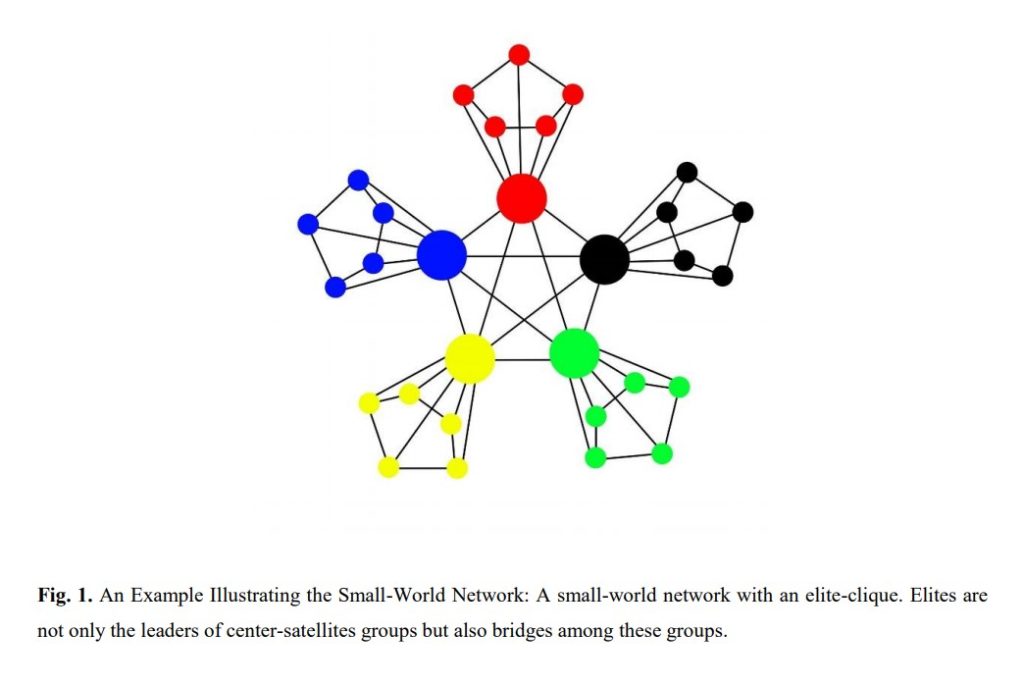

The researchers first observed existing firms in the Chinese VC industry via the SiMuTon Database to establish properties that must be reflected in the model. For example, they observed that there are few major firms (referred to as ‘elites’) that lead smaller groups. These smaller groups are connected by these elites, and therefore the edges between elites are actually bridges (as discussed in lecture) because removing them would break up the VC network. Furthermore, because of government intervention in China, there is a lot of uncertainty in the VC industry. Therefore, there is evidence of many alliances between VC firms to form higher trust and stability. These ideas were combined to form a small-world model representing the Chinese VC industry, which can be illustrated by the following example:

The ties between firms were determined by two factors. Firstly, the probability of an edge increased when two firms were mutually invested in some other. This uses the concept of relational embeddedness. The other factor uses structural embeddedness theory which says the probability of an edge increases proportionally to the number of common neighbours.

I find it very interesting that this development process followed the examples of small-world models we’ve seen in class. In particular, models such as Watts & Strogatz or Kleinberg’s use observations from experiments such as Milgram’s small-world experiment or the Columbia small-world study to help advance the accuracies of said models. Kleinberg’s model used the observed fact from Milgram’s experiment that as people sent their letter forward, the distance between the source and target typically halved.

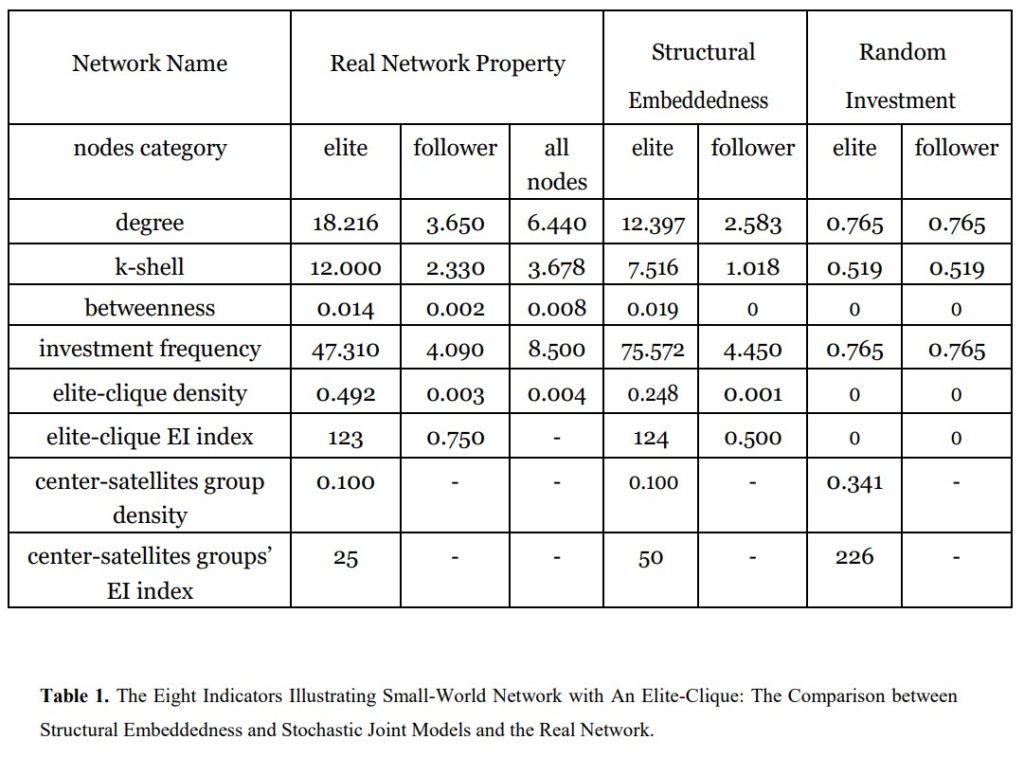

Finally, the model they developed was tested against a random model to determine if any features are noteworthy or not. This is similar to using Gnp as we have in class. It was also tested against the real data which showed that accounting for embeddedness helped significantly boost the accuracy of the overall model compared to the random model.

References

Gu, W., Luo, J., & Liu, J. (2019). Exploring Small-World Network with an Elite-Clique: Bringing Embeddedness Theory into the Dynamic Evolution of a Venture Capital Network. ArXiv, abs/1811.07471. https://arxiv.org/ftp/arxiv/papers/1811/1811.07471.pdf